Some context and perspective on the somewhat normal, albeit swift, pullback in U.S. equities.

NFT Market Insights - 101118Category: Markets

2018 Mid-Year Update

In this Mid-Year Update, we hope to highlight developments in global economies and markets that have either reinforced our thinking or given us reason to shift course. Please click below:

2018 Mid-Year UpdateThe 351st-Worst Day in Stock Market History

Some insights on the market activity of Friday, February 2. While the headlines may be loud, it is important to provide some much-needed context for the noise and hone in on the signal, which is quite normal and generally positive.

Click here for our Market Insights2018 Outlook: Continuing to Live in Interesting Times

A little more than a year ago, in the wake of surprising results in the U.S. presidential election, we forecasted elevated levels of market volatility in both directions. While the world at large has felt varying levels of uncertainty and unsteadiness since then, the markets grinded higher in an unprecedented fashion.

As a result, current valuations are lofty across the board as the momentum factor led asset classes to levels, on a cyclically adjusted price-to-earnings basis, rarely seen in history. At the same time, markets have also produced unanticipated and uncommon low volatility. The resurgence in global growth and a backdrop of very low interest rates and modest commodity prices has traditional Wall Street in a euphoria reminiscent of our early days in the industry.

Read more in our 2018 Outlook:

NFT 2018 OutlookWhen we work for free

There are times when we provide valuable guidance at no additional charge when our colleagues in the industry profit handsomely from it. And despite what our management consultant friends say, that’s fine.

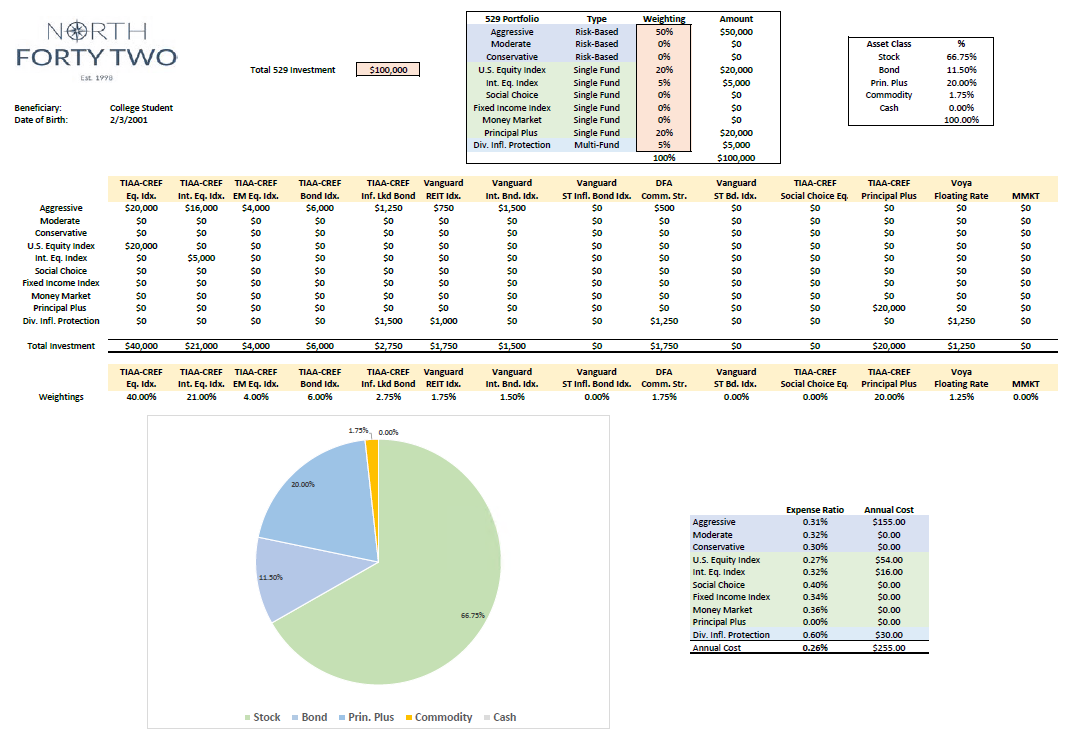

Saving for college is one of the most daunting challenges around for our peer group. Tuition inflation rates have historically run at twice that of general inflation, or around 6-7% annually. We are acutely aware of the shocking sticker price of four years of college; our two principals have (hopefully) five children going through over the next ten years.

Nearly two decades ago, around the start of our registered investment advisory (RIA) firm, mutual fund companies and state governments came together to develop the Section 529 plans that are a principal funding vehicle for many. These tax-advantaged accounts are an integral part of successful financial planning.

However, in many instances, 529 plans have been sold by traditional commission-based brokers who charge outrageous ongoing fees (either through A, B, or C shares of the underlying mutual funds themselves or in high-priced fee-based plans) for doing little outside of establishing an initial asset allocation.

In our client reviews, we have discovered thousands of dollars that have gone into financial advisors’ pockets, when those monies could have paid for textbooks and computers and pencils or even additional semesters of college. For a recent client, we were able to save them $2,000/year in unnecessary fees levied by a prior financial advisor.

Think about how much that is over the course of a decade or more of saving!

In our minds, it is a dereliction of fiduciary duty to charge a fee for funding and overseeing 529 plan accounts. Not that they aren’t important or meaningful, just that the structural restrictions imposed on the accounts by the IRS lend themselves to more static management, which is appropriate given the objective.

So we do the work to set up and oversee 529 plan accounts directly with the appropriate direct plan administrators, avoiding any unnecessary sales charges or fee arrangements that clients pay, but we don’t bill for that activity. It doesn’t feel right, it is to the advantage of our clients, and we can direct more dollars toward the noble and challenging cause of funding the higher education of future generations.

And we can sleep at night. At least until we remember how unbelievable college costs have become.

If you know of anyone struggling with college funding strategies (perhaps having been sold a sub-optimal 529 plan), ask them to reach out to us for a free review. Whether they can benefit from our comprehensive services or not, we can set their college savings strategy straight to achieve those goals in the most efficient and inexpensive manner.

Because it’s the least we can do to further the higher education aspirations of future generations.